Being "revenue neutral" occurs when a taxing jurisdiction budgets the exact same amount of property tax revenue, in dollars, for the upcoming budget year as they did for the current year.

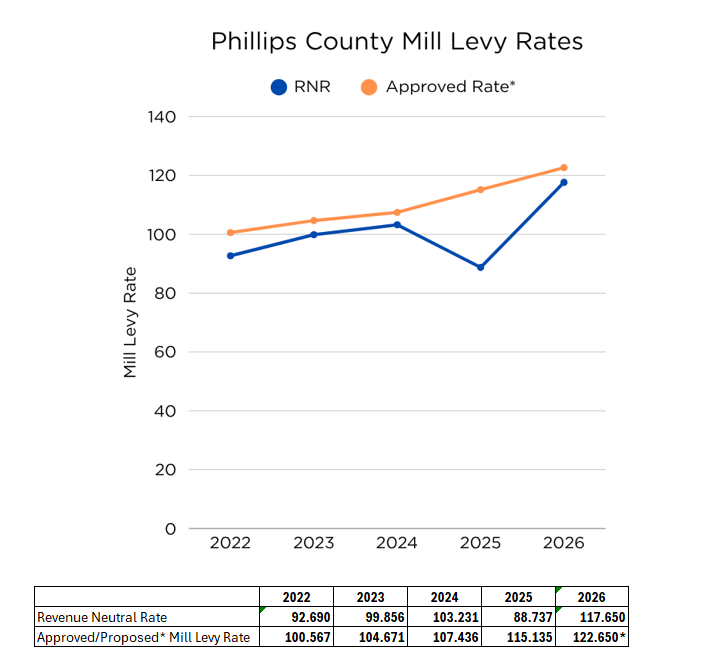

The "revenue neutral rate" is the mill levy rate required to generate the exact same amount of property tax dollars as the year before, using the current tax year's total assessed property valuations.

For example: If a taxing entity uses $1 million of property tax revenue in the current budget year, to be revenue neutral would require they plan to only use $1 million (or less) in the next year too. However, if a taxing jurisdiction plans to use more property tax dollars in the next budget year compared to the current year, they would exceed the revenue neutral rate and need to hold a public hearing.

*Kansas entities have used the Revenue Neutral Rate system to determine property taxes since its passage from the Kansas Legislature in 2021.