County Appraiser's Office

“The Phillips County Appraiser’s Office is committed to the mission of providing uniform, fair, and equitable appraisals to the public and the state."

.png)

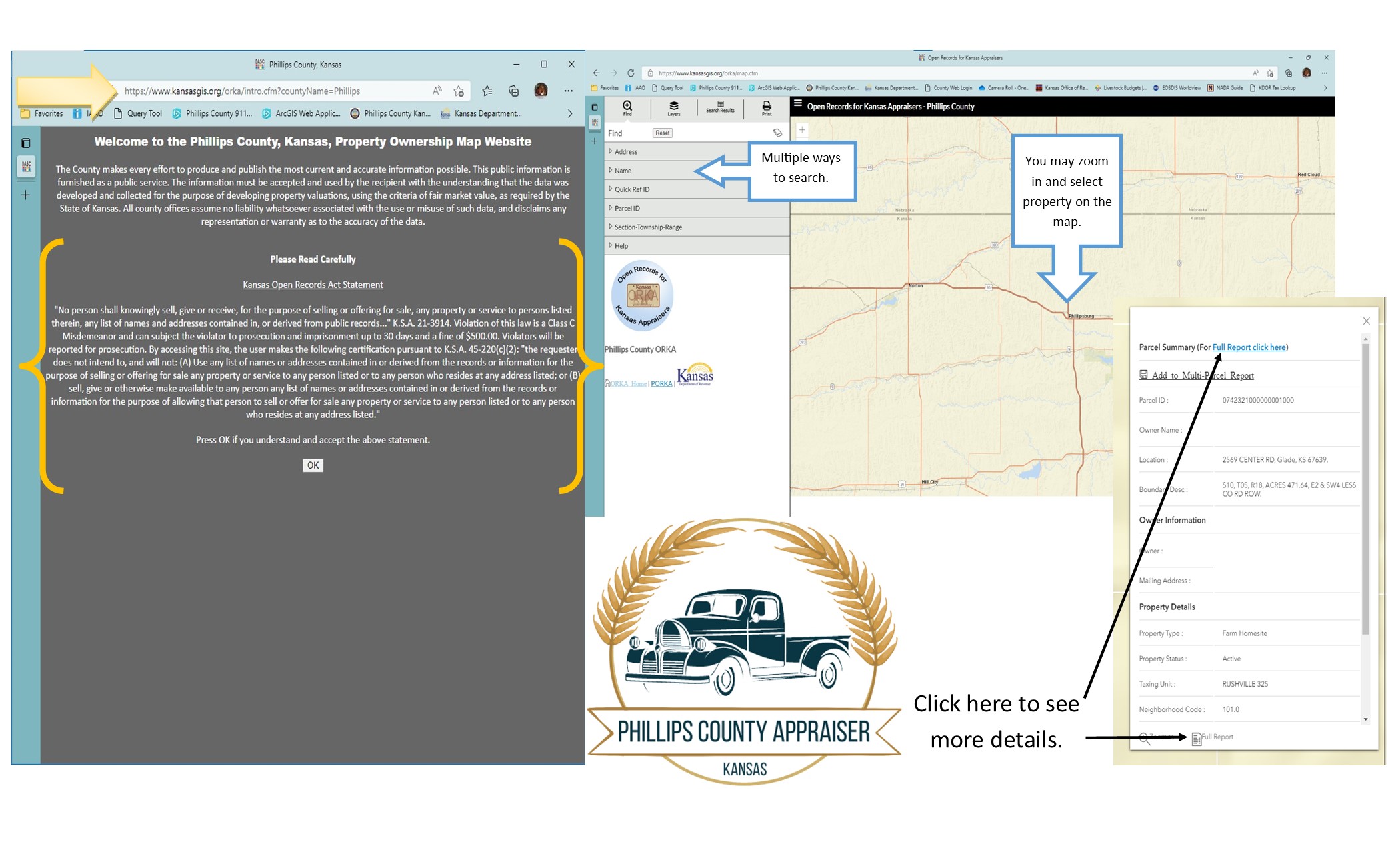

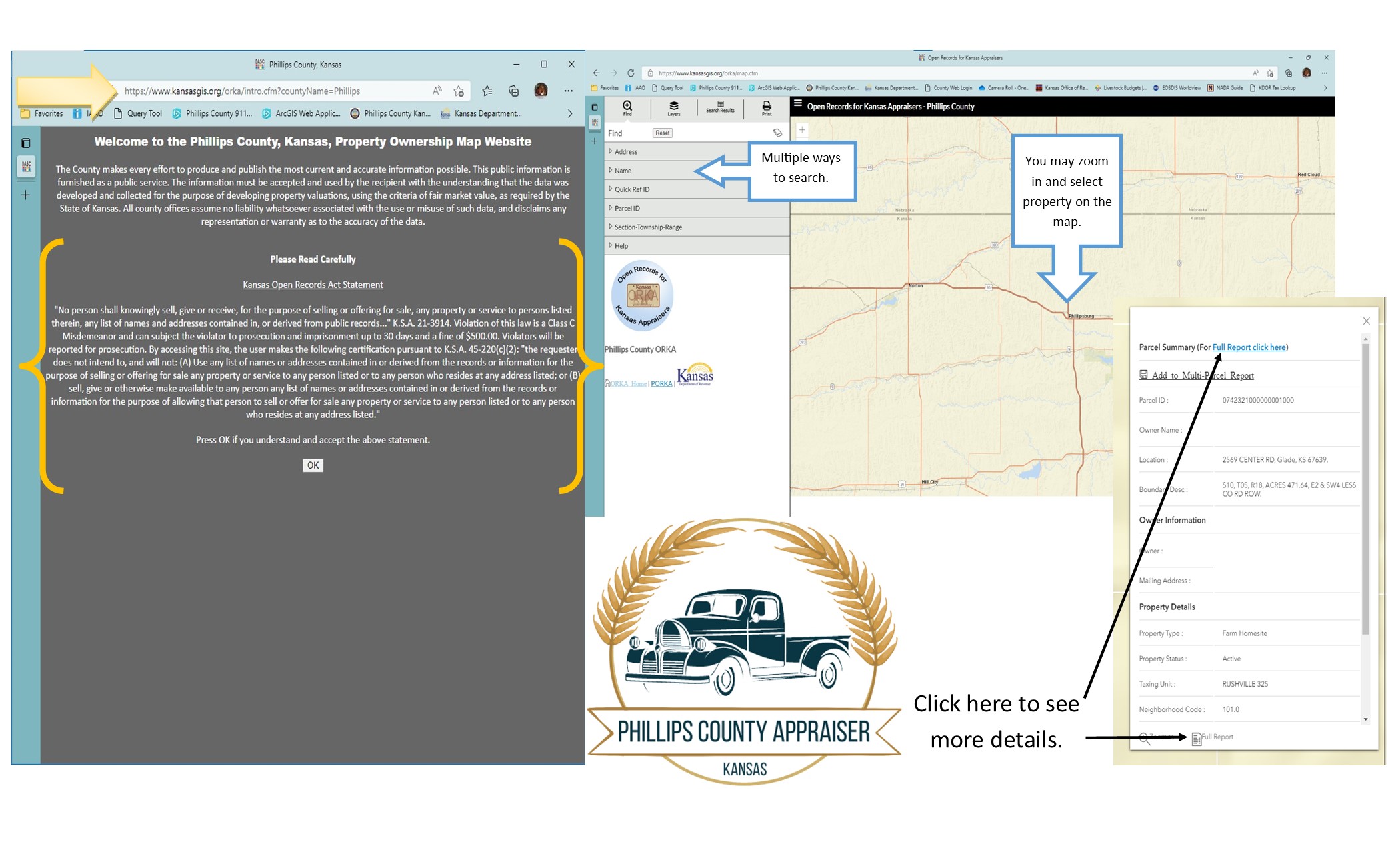

ORKA Free Parcel Search:

The Open Records for Kansas Appraisers is an informational website provided free to the counties by the State of Kansas. Here are a few tips to help navigate the website.

.png)